Pet Insurance Market Insights: Growth, Share, Value, Size, and Trends By 2032

Competitive Analysis of Executive Summary Pet Insurance Market Size and Share

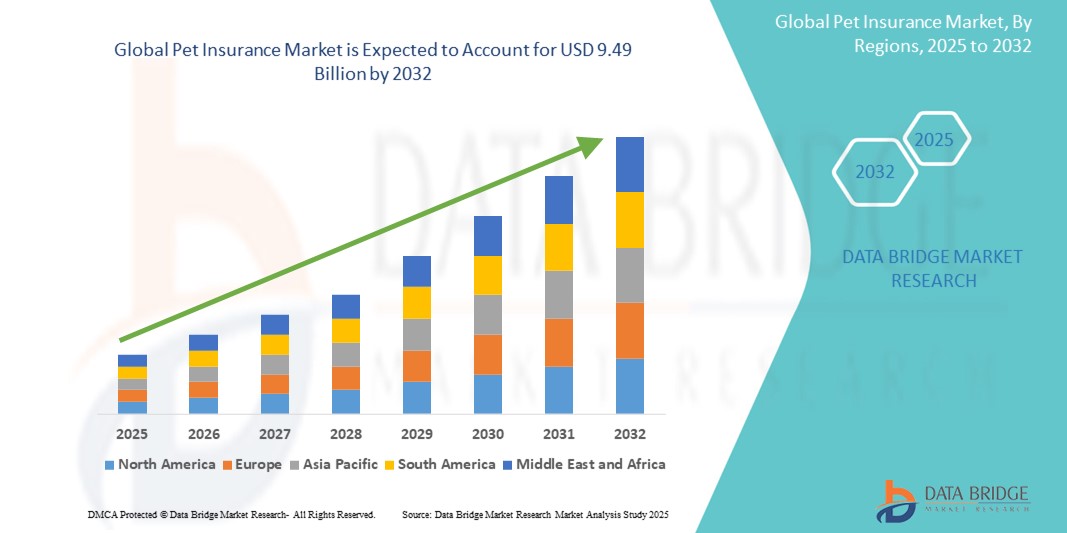

- The global pet insurance market size was valued at USD 47.32 Billion in 2024 and is expected to reach USD 9.49 Billion by 2032, at a CAGR of 94.00% during the forecast period.

To stand apart from the competition, a careful idea about the competitive landscape, their product range, their strategies, and future prospects is very important. Pet Insurance Market research report contains a comprehensive study of the product specifications, revenue, cost, price, gross capacity and production. Market report is a verified and consistent source of information that puts forth a telescopic view of the existing market trends, emerging products, situations, and opportunities. It provides noteworthy data, current market trends, future events, market environment, technological innovation, approaching technologies and the technical progress in the relevant industry.

Staying informed about the trends and opportunities in the industry is quite a time consuming process where Pet Insurance Market report actually helps a lot. The major areas of market analysis such as market definition, market segmentation, competitive analysis and research methodology are studied very carefully and precisely in the whole report. Various steps are used while generating this report by taking the inputs from a specialized team of researchers, analysts and forecasters. An excellent Pet Insurance Market research report can be generated only with the leading attributes such as highest level of spirit, practical solutions, committed research and analysis, innovation, talent solutions, integrated approaches, most up-to-date technology and dedication.

Get the edge in the Pet Insurance Market—growth insights and strategies available in the full report:

https://www.databridgemarketresearch.com/reports/global-pet-insurance-market

Pet Insurance Market Landscape Overview

Segments

- Based on the insurance type, the pet insurance market can be segmented into lifetime cover, non-lifetime cover, accident-only, and others. Lifetime cover policies are expected to dominate the market due to their extensive coverage throughout the pet's life.

- By animal type, the market is divided into dogs and cats, which are the most commonly insured pets. However, insurers are also offering coverage for birds, horses, and exotic animals, driving market growth.

- Considering the sales channel, the market is categorized into brokers/agencies, direct writing, and bancassurance. Direct writing through online platforms is gaining popularity among consumers due to its convenience and transparency.

- Geographically, the global pet insurance market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds a significant share due to the high pet ownership rates and increasing awareness about pet health.

Market Players

- Petplan Limited

- Anicom Holdings Inc.

- Trupanion Inc.

- Nationwide Mutual Insurance Company

- Hartville Group

- Pethealth Inc.

- PetFirst Healthcare LLC

- Embrace Pet Insurance Agency LLC

- Agria Pet Insurance Ltd.

- Hollard

- PetSure

- Royal & Sun Alliance Insurance Company of Canada, Inc.

These key market players are actively involved in strategic initiatives such as partnerships, mergers, acquisitions, and product launches to gain a competitive edge in the global pet insurance market. With the growing demand for specialized pet care and the rise in pet adoption rates worldwide, the market is poised for significant expansion in the coming years.

The pet insurance market is witnessing notable growth trends driven by various factors such as the increasing adoption of pets, rising awareness about pet health and wellness, and the growing trend of humanization of pets. One of the emerging trends in the market is the shift towards customization and personalization of insurance plans to cater to the specific needs of different pet owners. This trend is fueled by the evolving preferences of pet owners who are seeking comprehensive coverage that addresses not only medical expenses but also provides additional benefits such as wellness programs, preventive care, and even coverage for alternative therapies.

Another significant trend shaping the pet insurance market is the integration of technology to enhance customer experience and streamline insurance processes. Insurers are leveraging digital platforms, mobile apps, and data analytics to offer seamless services such as online claims processing, real-time policy management, and personalized recommendations based on pet health data. This tech-driven approach not only improves operational efficiency for insurers but also enhances customer engagement and satisfaction.

Moreover, the market is witnessing a surge in collaborations between pet insurance companies and veterinary service providers to offer integrated solutions that combine insurance coverage with veterinary care services. These partnerships aim to create holistic pet healthcare ecosystems that provide comprehensive support to pet owners, from preventive care and medical treatment to financial protection against unexpected expenses. By joining forces with veterinary clinics, pet insurance companies can establish a strong presence in the market and enhance their value proposition to customers.

Furthermore, sustainability and ethical practices are gaining prominence in the pet insurance industry as consumers become more conscious about the environmental and social impact of their choices. Insurers are increasingly incorporating eco-friendly initiatives, green practices, and ethical standards into their operations to align with the values of modern pet owners who prioritize sustainable and responsible business practices. By adopting a sustainability-driven approach, pet insurance companies can not only appeal to environmentally conscious consumers but also contribute to the overall well-being of pets and the planet.

In conclusion, the global pet insurance market is undergoing dynamic changes driven by evolving consumer preferences, technological advancements, strategic partnerships, and a growing focus on sustainability. As the market continues to expand and innovate, pet insurance companies that adapt to these trends and deliver value-added solutions to customers are likely to thrive in the competitive landscape. By staying attuned to market dynamics and leveraging new opportunities, market players can position themselves for sustained growth and success in the evolving pet insurance industry.The pet insurance market is currently characterized by several dynamic trends and developments that are reshaping the industry landscape. One of the most significant trends is the increasing importance of customization and personalization of insurance plans to cater to the diverse needs and preferences of pet owners. This trend reflects a shift towards more tailored offerings that go beyond traditional medical coverage to include wellness programs, preventive care, and alternative therapies, mirroring the evolving demands of pet owners who view their pets as integral members of the family.

Moreover, the integration of technology into the pet insurance sector is playing a crucial role in enhancing customer experiences and optimizing insurance processes. Insurers are increasingly leveraging digital platforms, mobile applications, and data analytics to streamline services such as online claims processing, real-time policy management, and personalized recommendations based on pet health data. This tech-driven approach not only boosts operational efficiency but also fosters deeper engagement with customers, ultimately leading to higher satisfaction levels and retention rates.

Additionally, the pet insurance market is witnessing a surge in strategic collaborations between insurance companies and veterinary service providers to offer integrated solutions that combine insurance coverage with comprehensive veterinary care services. Such partnerships aim to create holistic pet healthcare ecosystems that provide end-to-end support to pet owners, from preventive care and medical treatment to financial protection against unexpected expenses. By aligning themselves with veterinary clinics, pet insurance companies can enhance their service offerings and create added value for customers, thereby strengthening their market position and competitiveness.

Furthermore, sustainability and ethical practices are emerging as key focal points within the pet insurance industry, driven by the growing consumer awareness of environmental and social issues. Insurers are increasingly adopting eco-friendly initiatives, green practices, and ethical standards in their operations to resonate with the values of environmentally conscious pet owners. By embracing sustainability-driven strategies, pet insurance companies not only appeal to a broader customer base but also contribute to the overall well-being of pets and the planet, aligning themselves with the preferences of modern consumers and industry trends.

In conclusion, the pet insurance market is undergoing a period of significant transformation fueled by evolving consumer expectations, technological advancements, strategic partnerships, and a heightened emphasis on sustainability. Market players that adapt to these trends, innovate their offerings, and demonstrate a commitment to customer-centric solutions are likely to thrive in the competitive landscape. By staying nimble, responsive to market dynamics, and embracing opportunities for growth and innovation, pet insurance companies can position themselves for long-term success and leadership in the ever-evolving pet insurance industry.

Study the company’s hold in the market

https://www.databridgemarketresearch.com/reports/global-pet-insurance-market/companies

Custom Question Framework for Global Pet Insurance Market Reports

- How big is the Pet Insurance Market as of the latest report?

- What is the growth projection for the Pet Insurance Market over the forecast period?

- What are the different categories or segments examined?

- Which firms have a stronghold in the Pet Insurance Market?

- What new product launches have emerged recently?

- What countries’ performance metrics are analyzed?

- What is the highest growth region in the current analysis?

- Which nation could take the top spot in the market landscape?

- Which area currently dominates the market by share?

- What country is likely to achieve peak growth by CAGR?

Browse More Reports:

Global Chronic Cough Market

Global Citrus Oil Market

Global Clinical Alarm Management Market

Global Clinical Communication and Collaboration Software Market

Global Cloud Computing Insuretech Market

Global Cloud Providers Green Data Center Market

Global Cloud Services Brokerage Market

Global Coatings Raw Materials Market

Global Coconut Milk Market

Global Coenzyme q10 Market

Global Coffee Premixes Market

Global Coil Coating Market

Global Cold Pain Therapy Market

Global Cold Stamping Body in White Market

Global Colostrum Replacer Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness